san antonio local sales tax rate 2019

City sales and use tax codes and rates. There is no applicable county tax.

Fiesta And The City What Is Fiesta Week And How Does It Impact The City Of San Antonio Fiestamedal Net

05 lower than the maximum sales tax in FL.

. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. 2015 stingray boat price fresco play node js hands on answers. Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows.

Every 2019 combined rates mentioned above are the results of Texas state rate 625. Recommendation letter university sample. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage.

The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. Texas Comptroller of Public Accounts. San Antonio collects the maximum legal local sales tax.

Local Code Local Rate Total Rate. This is the total of state county and city sales tax rates. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San.

The minimum combined 2022 sales tax rate for San Antonio Texas is. The San Antonio Texas general sales tax rate is 625. There is no applicable city tax or.

The San Antonio Texas general sales tax rate is 625. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The Texas sales tax rate is currently.

The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to. 4 rows San Antonio TX Sales Tax Rate.

Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special. The san antonio texas sales tax is 825 consisting of 625 texas state sales tax and 200 san antonio. The current total local sales tax rate in San Antonio.

Jurors parking at the garage. Rates will vary and will be posted upon arrival. 127 rows Birmingham has the highest local option sales tax rate among major cities at 6 percent.

The current total local sales tax rate in san antonio tx is 8250.

Small Business Entrepreneurship Department Bexar County Tx Official Website

Current Tax Rate District Comal Independent School District

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Why Texas Auto Dealers Are Adopting Solar Energy San Antonio Business Journal

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Most Texans Pay More In Taxes Than Californians Reform Austin

Why Moving To San Antonio Texas Is A Good Decision

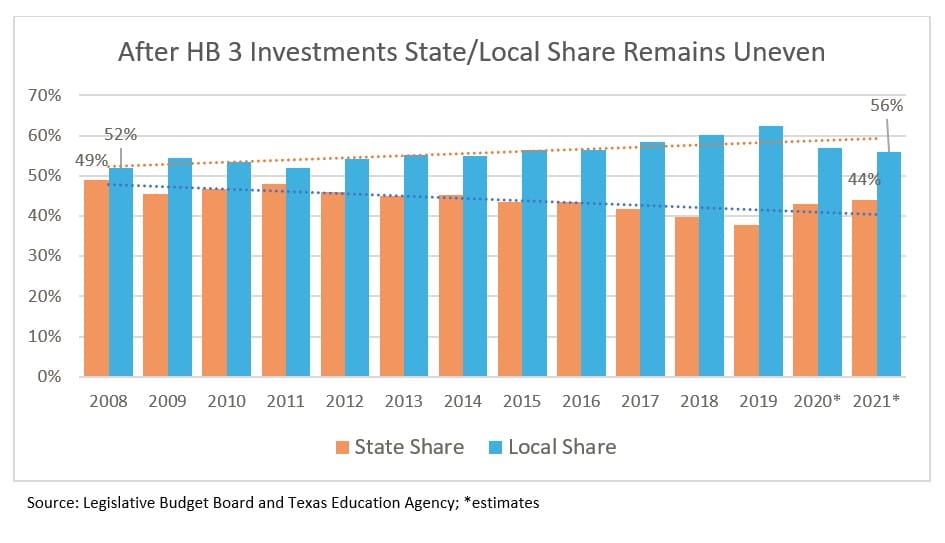

A New Division In School Finance Every Texan

U S Cities With The Highest Property Taxes

20426 Lorena Xing San Antonio Tx 78264 Realtor Com

Tac School Finance The Elephant In The Property Tax Equation

Used Ford Edge For Sale In San Antonio Tx Cargurus

California Sales Tax Rate Rates Calculator Avalara

San Antonio City Council Provides Additional Property Tax Relief For Residents Kens5 Com

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

How Much Will San Antonio S Homestead Exemption Help Your Tax Bill The City Has A Plan

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal